consumer brands

BEVERAGES

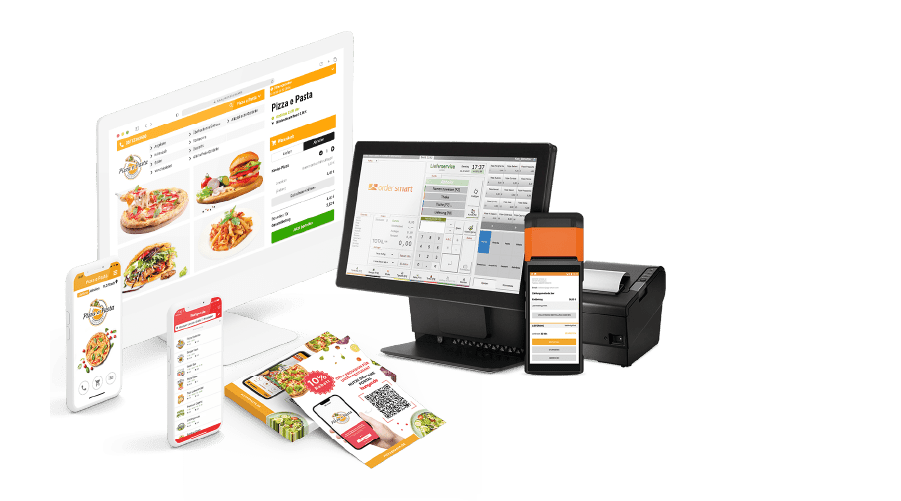

FOODTECH

RETAIL, ECOMMERCE

AGRIBUSINESS

ALTERNATIVE PROTEIN

FOOD SUPPLEMENTS

RESTAURANTS, CATERING

MACHINERY, EQUIPMENT

BAKED GOODS

PET FOOD

DAIRY

SNACKING

Meat, Fish

Food ingredients

FÜHRENDER FOOD M&A-BERATER

MATTERLING ist ein Trusted M&A Advisor für Transaktionen in der Lebensmittel- und Getränkeindustrie im deutschsprachigen Raum. Wir sind überzeugt, dass unsere Branchenspezialisierung für den Erfolg unserer Kunden maßgeblich ist. Unsere Kunden profitieren von unseren fundierten Branchenkenntnissen, unserer führenden Transaktionserfahrung, unseren globalen Beziehungen zu Investoren, Käufern und Zielunternehmen sowie unserem pragmatischen und partnergeführten Beratungsansatz.

Unternehmensverkauf

Wir beraten Kunden, die ihr bzw. ein Unternehmen veräußern wollen. Unser Ziel ist es, die beste Kombination aus Preis, Transaktionsstruktur und kultureller Kompatibilität innerhalb eines vereinbarten Zeitrahmens zu erzielen. Wir entwickeln eine überzeugende Equity Story und erstellen eine qualifizierte Auswahlliste potenzieller Käufer. Wir schaffen eine diskrete, aber wettbewerbsintensive Angebotssituation, führen die Verhandlungen und managen aktiv den Verkaufsprozess bis zum rechtlichen Abschluss.

Unternehmensakquisition

Wir beraten Kunden, die eine Akquisition im Rahmen von strategischen Übernahmen, Buy&Build-Strategien, LBOs, MBOs, MBIs oder öffentlichen Übernahmen anstreben. Aufgrund unserer Branchenspezialisierung können wir originäre Investitionsideen entwickeln. Wir sind erfahrene „Türöffner“ und initiieren einen vertraulichen Dialog mit den Zielunternehmen. Wir bewerten die Zielunternehmen, empfehlen die am besten geeignete Art der Strukturierung und Finanzierung der Transaktion und verhandeln den bestmöglichen Kauf.

Kapitalbeschaffung

Wir helfen Wachstumsunternehmen bei der Kapitalbeschaffung bei Investoren, die in Bezug auf Branchenschwerpunkt, Geschäftsmodell und Wachstumsphase am besten geeignet sind. Der Fundraising-Prozess kann eine schwierige und zeitaufwändige Aufgabe sein, aber wir wissen, wie wir unsere Kunden am besten unterstützen können, damit sie sich auf die Führung ihres Unternehmens konzentrieren können. Und durch unser starkes internationales Netzwerks bieten wir einen effizienten Zugang zu einer Vielzahl relevanter Investoren, einschließlich VCs, PEs, Family Offices und Corporates.

Deals

MATTERLING hat eine Vielzahl von Transaktionen in der Lebensmittel- und Getränkeindustrie in ganz Europa durchgeführt und dabei mit vielen führenden Unternehmen, bekannten Marken und außergewöhnlichen Unternehmern zusammengearbeitet. Unser Team hat über 50 Transaktionen erfolgreich abgeschlossen. Ausgewählte Referenzen siehe folgend.

Kontakt

Adrian Fröhling